After many years of defending its position on no advertising for its viewers, Netflix plans to finally consider an ad-supported TV subscription model. This is huge news for the platform, and it just might be the right decision.

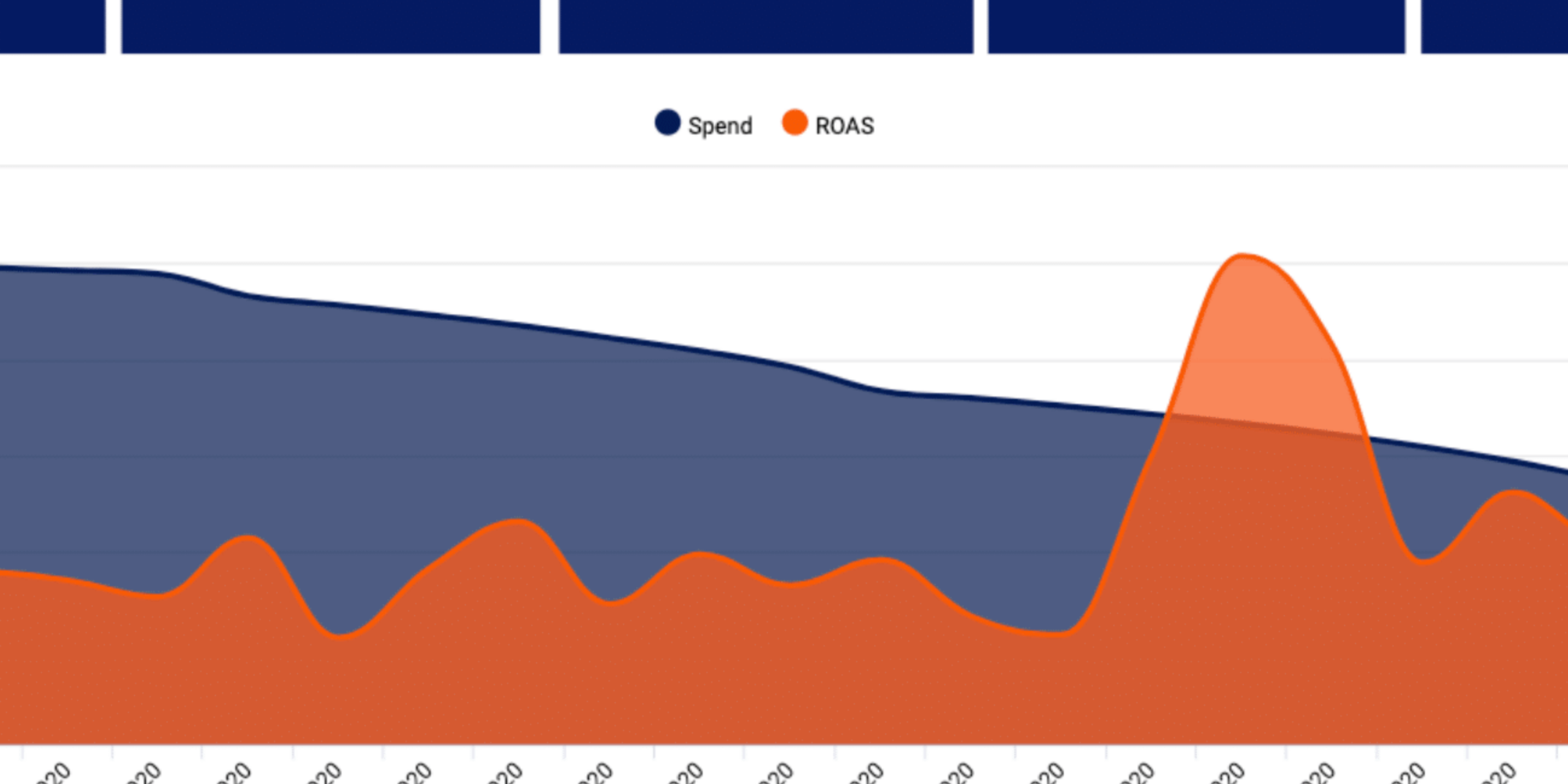

Our industry statistics show that free ad-supported TV has grown 4.9% quarter-over-quarter since last year. This means viewers are opting to receive connected TV ads or are willing to receive connected TV ads to pay a little less for their TV subscriptions.

To put this into context, here are a few streaming services subscription prices that also include TV commercials:

- Peacock: $4.99/month

- Paramount Plus: $4.99/month

- Hulu: $6.99/month

- HBO Max: $9.99/month

As mentioned in our Connected TV in 2021 winner blog, Netflix is becoming the victim of its own success.

Why is Netflix losing subscribers?

Just a few years ago, it held a significant amount of premium TV streaming content and viewers, minimal competition, and low subscription prices. Today, the surplus of streaming networks is setting Netflix with a 5% decline in Netflix users year-over-year.

With a standard Netflix account at $15.49/month, a number of Netflix subscribers aren’t finding the benefit in the platform any longer when many of their favorite shows and new “must-watch” series are launching on other streaming platforms. I mean, could you tell us what’s on Netflix right now?

Viewers are the priority of 2022. They expect a consistent and strong flow of content from streaming platforms, or they cancel their subscriptions and move on.

What’s next for Netflix?

This shift to Netflix advertising could be crucial to maintain its customers, but the company will be starting from the bottom up. For example, Hulu’s DNA has always been to serve connected TV ads.

Other platforms, like Peacock and NBCUniversal, have an entire team dedicated to selling ad space. These platforms have the infrastructure already in place with experience in testing videos, measuring performance, and utilizing the data to optimize.

Keynes believes the best way to approach this situation would be to partner with an established SSP, like Magnite, which already has a history of running video ads and fail-safes established to avoid starting from scratch.

This is also an exciting opportunity for the company to be original with how they plan to run connected TV ads within the platform. Will they do 90-second commercial breaks like most connected TV platforms, or will they step outside the box and introduce a new method of running connected TV ads? Will they charge a flat CPM rate, or be entirely programmatic?

Selling commercials programmatically would open a whole new avenue for brands of all sizes to bid on and reach their target consumers and create a more customized experience for customers.

So, for Netflix to stay competitive, offering an ad-supported TV version is the principal move. It’ll always have a foundation of people who will pay the $15/month for no TV commercials, but with its decline in viewers, it needs to make a move and make it fast.