Data transparency and data segments are crucial when it comes to accurately targeting your audience.

Evan Hills, a seasoned advertising technology expert in business development and strategy at Dstillery, sat down with us to enlighten marketers on how data transparency affects the way an advertiser targets an audience. In this article, he shares insights on what to expect and where to begin progressing in this shifting “opt-in” industry in order to continue targeting users with successful marketing campaigns.

Q: What is the IAB’s Data Transparency initiative?

The IAB Tech Lab’s Data Transparency standards are intended to provide a common framework to describe pre-built data segments. The initiative is intended to do a few things:

Create a common language that all data providers use to describe segments.

Create standardized classifications to ensure all segments align with other standardized classifications

To establish a requirement for data sellers to disclose details enabled to inform buy decisions on how segments are created. They’ve even formed a compliance program to recognize data sellers that opt-in to this amount of transparency.

Q: In layman terms, what are these data labels?

The analogy is the FDA’s ‘nutrition facts’, but for data segments – we will describe the objective ingredients that go into a given segment, but it’s up to the data buyer, to determine what the correct dietary / nutrients mix is for your brand/campaign/initiative – For a campaign, the idea is that if you as a buyer know what goes into a segment, you can make an informed buy or no-buy decision.

Q: With so many data providers out there, why do these labels make a difference?

Similar to the IAB standardizing the 300×250, we’re now standardizing the way the industry describes data segments. It is important to understand that the data industry, in revenue, is about the size of the MLB, yet most data is being bought based on the data providers brand name. The irony is not lost that we are a data-driven industry, yet our buying decisions are based on who we’ve heard of.

Q: What are the key fields to look out for on the data label?

Audience count is an important first check – if there are about 4 million cars sold each year, why are there hundreds of millions of ‘auto intenders’?

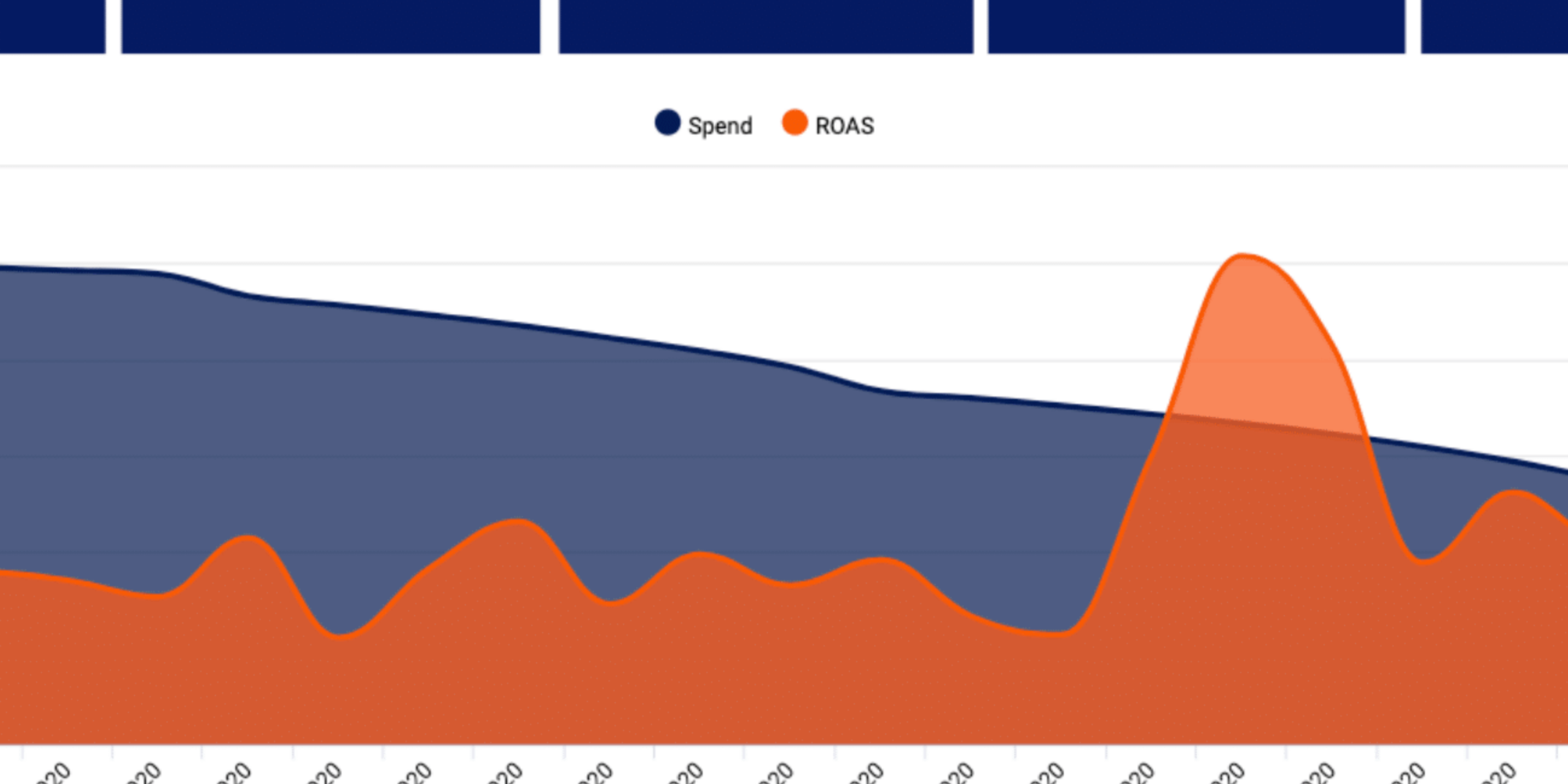

Other fields I’d look at are last refresh date, source refresh frequency and event lookback window – all of these in concert should give you a good handle on how a segment is updated, and at what cadence, which we find to be a good determinant of performance.

It’s also important to understand the goals of your specific campaign. If the campaign is just focused on targeting folks based on data points that don’t change frequently, like demographics, then you don’t need to worry as much about the freshness of the segment. For intent-focused campaigns – acquisition, site traffic, etc – we believe this is when the freshness of the segment is a key determinant of performance.

Q: What can a small/medium advertiser do to make sure they are buying the most relevant data?

Use your own data. USE YOUR OWN DATA! Ideally, all targeting decisions should be rooted in your first party data – custom prospect modeling, data-driven segment selection etc. Now that I got that off my chest, in addition to centralizing your first party data and knowing how to use it, it’s important to develop data-driven targeting theses, and constantly test them. The smartest brands I see are constantly trying new things to understand how they can best enhance their business. Test and learn, and make sure to leverage those learnings moving forward.

Q: If you were predicting the next 2 years. How do we think the landscape will change?

I think the most important trend to follow is the path towards an opt-in world. This started with GDPR and Safari, and is now moving to iOS and Chrome – and I believe that before it’s all said and done, even US privacy legislation will become opt-in. This is a win for consumers, provided there’s a well-informed discussion around the value exchange, or ‘quid-pro-quo’, of the digital ecosystem. The impact of this transition on our industry cannot be overstated – there will be pockets of consumers that are blind to brands and the wider adtech community, and that’s not a bad thing. This will drive a whole new wave of innovation in the targeting and measurement worlds, and will ultimately yield a cleaner, more buttoned-up ecosystem, all of which strikes me as a good thing. This also means that what was simple before – retargeting as an example – will require much more data science and machine learning.

Circling back to the data transparency initiative, this will only become more important, as there will be more targeting vehicles in the future, all of which will require transparency into how they work. Monolithic audience targeting will go away, and targeting buyers will need to understand not just how an audience segment is built, but how an inventory targeting algorithm is constructed, how their contextual solution works, and how their proprietary cohorts were built.

Q: What is your advice for any marketers looking at deciding on a data provider?

Transparency, efficacy and education. Focus on getting answers to questions like – How transparent is my data provider with how they build their segments? Do the segments perform well for this campaign or initiative? Did the data provider teach me something about my customers that I would have otherwise not known? I think if you find data providers that help you get good answers to those questions, you’ll be on the right track.

This interview featured Evan Hills, SVP of Business Development and Strategy at Dstillery, a custom audience solutions partner for agencies and brands. Evan is an ad tech native, an award-winning data enthusiast (named a NYC Television Week 40 Under 40 Media Innovator), and a proven builder throughout his experience in the industry. He went on to lead Dstillery’s pivot from a DSP to an audience solutions company and currently focuses on defining Dstillery’s post-cookie strategy and international expansion.