We sat down with John Kelly, CEO of Zenreach a leading in-store ad-tech and wifi provider with over 48 million US consumers within its network. To give context, they partner with locations ranging from coffee shops to high-end retail shopping centers and are able to build hyper targeted advertising campaigns (email, social and programmatic) to reach in-store shoppers.

Q: What have you seen from user behaviour from in-store to online?

JK: Clearly, foot traffic to retail shops, restaurants, and offline venues across the country is down quite significantly. Our data shows that foot traffic dropped 60% in March as the stay-in-place orders started to roll out. As a country, we hit our low point in mid-April when in-store traffic was down 75% from the previous year.

Obviously, that is a huge decline, and to my knowledge, we have never seen such a precipitous drop in foot traffic. From the period of mid-April through June, we saw a slow but steady increase in foot traffic, and we climbed back up to 50% of last year’s numbers. Of course, that is still quite a bit down from normal, but the trends were looking encouraging. However, since July, we have seen a flattening of retail traffic, and we have remained around the 50% mark for the past several months.

As we consider the possibility of continued COVID-19 cases and the continuance (if not, return) of some form of business restrictions, we do not see a return to pre-COVID levels of foot traffic. We furthermore expected to see even more people shopping online in the final three months of the year, especially with Amazon pushing its annual Prime Day from July to October. In the year prior, hundreds of other retailers also offered their own deals and discounts around the event. It is clear Amazon is influencing many others in the online retail space, which will likely lead to an acceleration of the online shopping trends we have been seeing throughout the pandemic.

But there are a number of reasons for offline retailers to be optimistic. Several studies have shown that despite the explosive growth of ecommerce, the tactile in-store shopping experience is still very powerful, as evidenced by the fact that even during a global pandemic, half of all consumers are still shopping in stores.

Q: We’ve seen DTC online only stores thrive during the pandemic, with low overheads, online marketing dialed in and older generations moving to online-only shopping. When the country started to reopen did you see a trend of people going back to brick-and-mortar locations?

JK: As I mentioned above, we did see around 10 consecutive weeks of solid, sustained growth in foot traffic following the mid-April trough as many states began to relax restrictions. However, over the past several months, we’ve seen virtually no growth in foot traffic percentage—the nation has been hovering around 50% of last year’s figures since July.

Q: How does Zenreach straddle the online/offline model that will be evermore crucial in a post-covid world?

JK: First, it is clear from the data that a big proportion of the population has concerns about offline shopping during this period. In that environment, it is critical that merchants take safety precautions to alleviate consumer concerns—doing things such as sanitizing areas, maintaining social distancing, implementing mask policies, etc. But simply taking these precautions is not enough. It is imperative that merchants let their consumers know about these actions. We have been instrumental in helping our clients get the word out to their consumers about their safety precautions and that they are open for business.

Second, now more than ever, it is vital that merchants are able to identify and connect with their most valuable consumers. If you have limited capacity in your store, you want to make sure that you bring in your loyal, high-value consumers, and not the low-ticket, one-and-done consumers. Because of our ability to determine the most frequent and high-value consumers, we have been instrumental in aiding our merchants to bring those consumers back. Even if your location is closed, we can leverage the same analysis to drive consumers to buy-online-and-pick-up-in-store or delivery, which has been particularly successful during this period.

Third, we have a large network of consumers with very valuable data about their offline shopping habits. For example, we have almost a million “fine diners” in our network (people that have gone to a high-end restaurant in the last year). That audience is attractive not just to fine dining establishments, but also to merchants that cater to consumers with higher disposable incomes, like jewelry retailers or language learning software providers. We have been able to leverage that audience to effectively drive new customers for those brands.

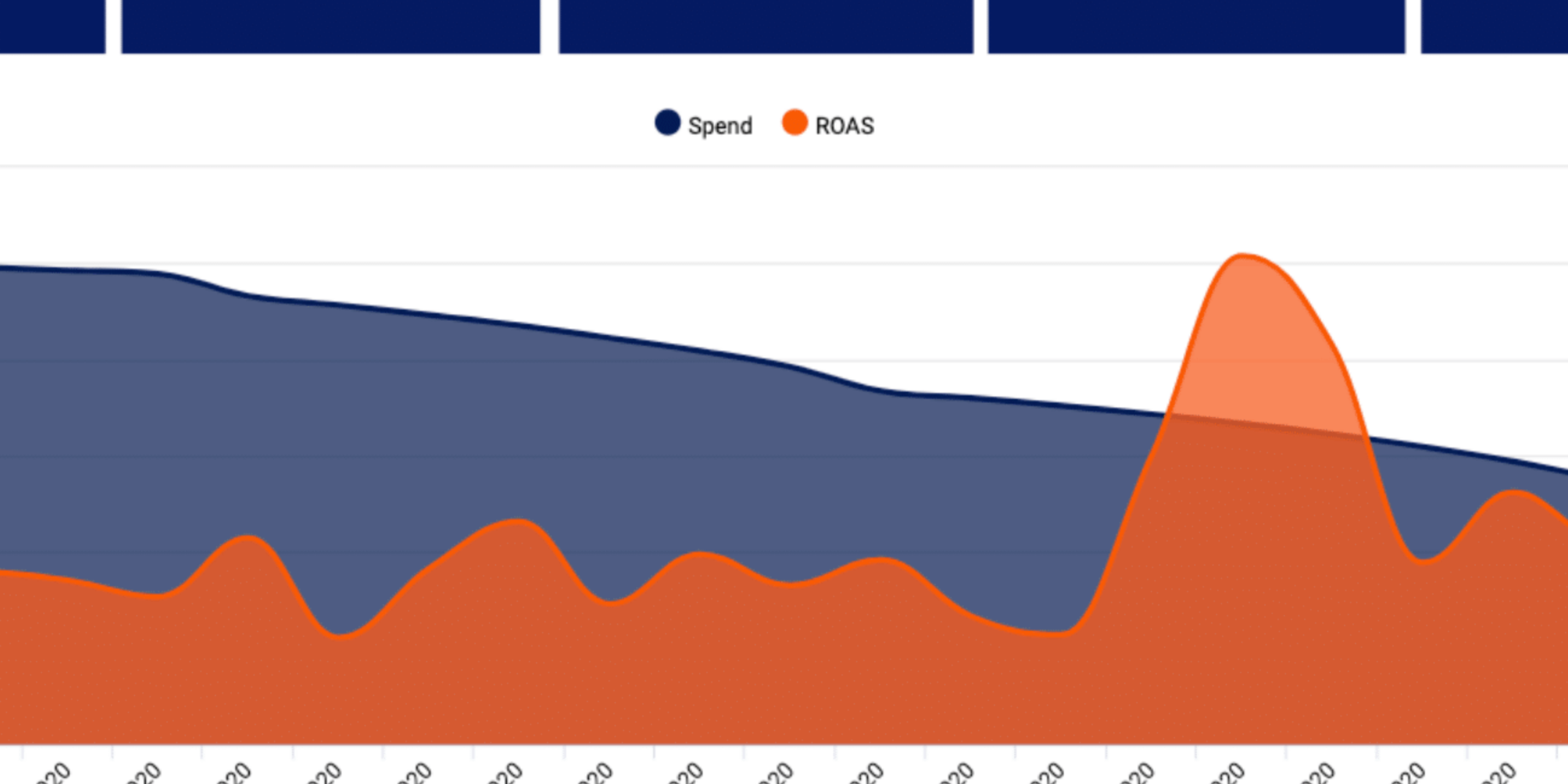

Fourth, we have seen some incredible performance in our advertising solution during this period. The combination of record-high online engagement along with lower internet advertising costs during this crisis has meant that we have seen some amazing performance numbers. In fact, we have had a few campaigns with click-through rates as high as 2-3%, which is roughly 20-30x higher than pre-COVID averages. That performance, along with our ability to reach a unique audience, has helped us help our clients see some very strong advertising performance and increased sales.

As for new things, we have made tremendous investments in the accuracy of our data and our understanding of the consumer journey from retail store to website and vice versa. Regarding the latter, we are in beta today with a few clients, and the results are very encouraging in being able to accurately depict the consumer journey. As most of us suspect, some consumers engage in multiple touch points between the website and the physical store before making a purchase. We will be excited to share more broadly what we learn once these preliminary studies are finalized.

Q: In summary, what should advertisers be doing to prepare for the country to reopen?

JK: Though it may seem counterintuitive with foot traffic down by 50% compared to last year, now is actually a great time to boost online advertising for new customers. As I noted above, more people are spending more time online, and ironically, because many advertisers have pared back their online spend, the cost of online inventory is comparatively low.

Perhaps most importantly, advertisers need to be empathetic in their messaging. This pandemic has brought about unprecedented challenges to our business community, with many businesses being forced to close and others forced to take on new challenges that they did not anticipate (e.g., new safety procedures). These changes have brought tremendous stress on business owners and have created new social strains for our society. I hope that all of us can find a way to work together—not against one another—to get through this challenging period.

John Kelly, CEO of Zenreach’s, has extensive experience in both ecommerce and ad tech. Prior to joining Zenreach, he was Head of Seller Growth at eBay and VP of sales at Criteo, a company that pioneered retargeting technology. John has a B.A. from Brown University, a J.D. from Georgetown University, and is a Fulbright Scholar.