This is custom heading element

Squid game, Amazon buying MGM, and Sex and the City were not the only things that made 2021 a year to remember in the digital TV streaming industry.

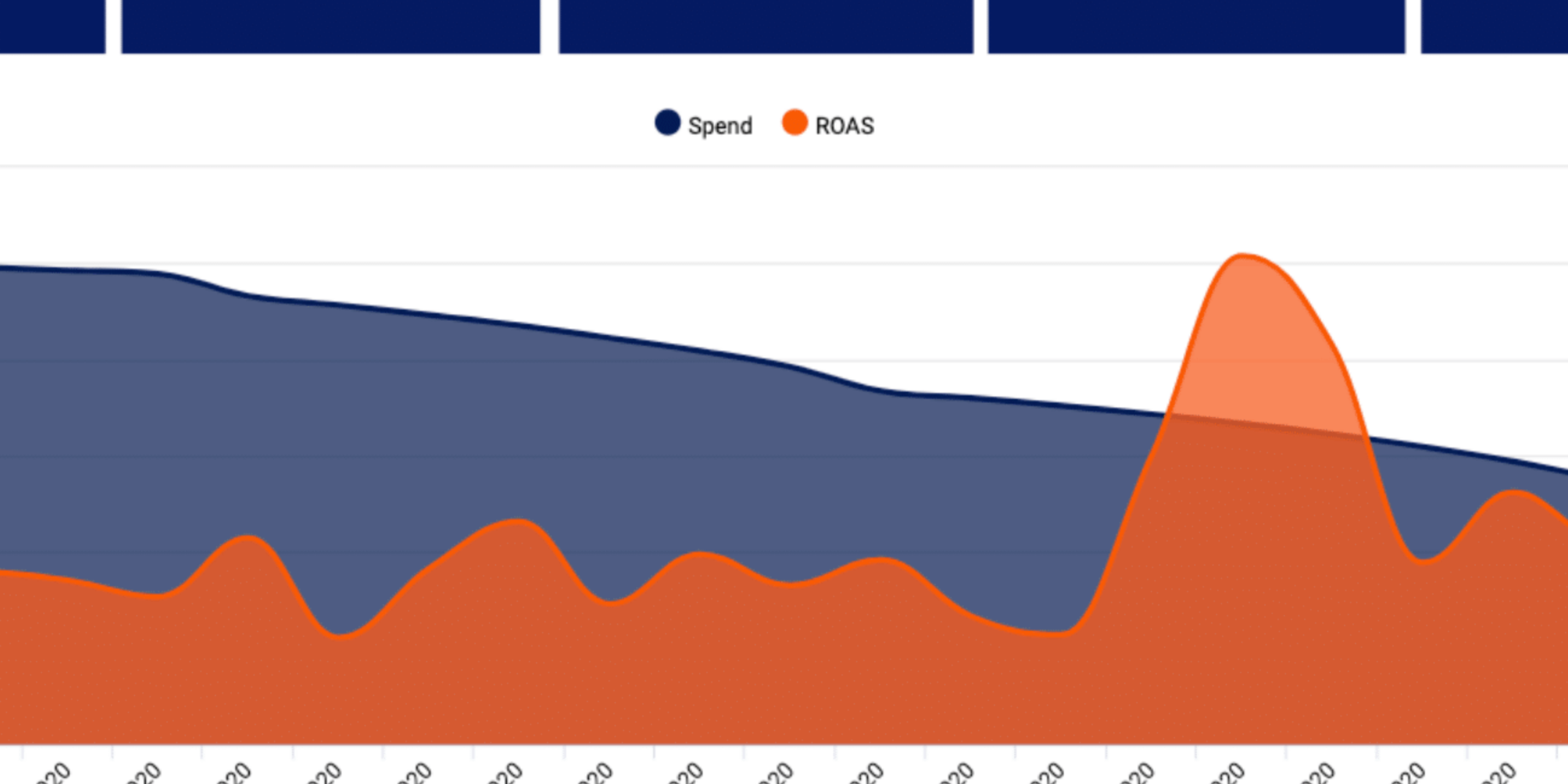

In early 2021, people asked us how the pandemic affected business. With more people watching TV at home and signing up for digital streaming subscriptions, advertisers began seizing the opportunity of implementing Connected TV advertising into their digital marketing strategies.

However, a small industry concern was whether or not the increased TV consumption would revert back to 2019 growth levels once the COVID-19 pandemic fizzled out.

Following 2021, the aforementioned concern is long gone. Last year did not only prove that people will consume just as much content as the country reopens but also that consumers will continue to sign up for more TV streaming subscriptions, fueling content wars between TV networks in 2022. This means a massive shift for viewers and advertisers alike.

Takeaways in TV of 2021

- 85% of US households have at least 1 digital TV subscription.

- Subscription stacking has increased to 4.7 subscriptions per household up from 3.5 in Q4 2020.

- Free Ad-Supported TV (FAST) increased by 4.9% quarter-over-quarter, such as Peacock, Plex, Crackle, and Pluto TV.

- Ad-Supported Video-On-Demand (AVod) increased by 3.6% quarter-over-quarter, such as Hulu, Pluto TV, The Roku Channel and Peacock.

- Netflix user base declined by 5% year-over-year.

- Single show networks are struggling to keep subscriptions.

- Premium content is being produced and held by networks on their own apps and subscriptions.

What does this mean for TV content in 2022?

Viewers will be the winners of 2022.

In the last year and a half, the majority of people have shifted from traditional cable packages to streaming services subscriptions. In other words, we’ve upgraded from paying technicians to install cable into our homes to signing up for a simple and inexpensive way to stream an abundance of content at any time. With these streaming services also comes flexible options of canceling subscriptions if the service or content does not meet expectations.

Netflix, for example, is becoming the victim of its own success. 5 years ago it held all the TV streaming content with minimal competition for $7.99 per month. Today, the industry has a plethora of streaming networks producing their own content, leaving Netflix with a dip in viewers, forcing them to increase their prices to $15.50 per month.

Viewers expect a consistent and strong flow of content from streaming platforms. With the convenience of being able to cancel a subscription at any time, viewers are finding loopholes. For example, Apple TV+ produces 2 to 3 series showcasing huge celebrity names and productions for $4.99 per month. Our learnings on viewers’ behaviors show that after watching the first season of a series, they cancel their subscriptions until the following seasons are released.

We couldn’t stress enough how important it is for networks to consistently produce large-scale TV content to maintain user subscriptions. The solution for networks in 2022 is more content, more shows, and more choice.

What does this mean for advertisers in 2022?

Viewers are moving towards ad-supported content even more than in 2020.

Viewers are accepting advertisements in exchange for lower TV streaming subscription prices. With now almost 5 subscriptions per household, consumers are either choosing not to pay a subscription or pay a small subscription fee for ad-supported or ad-subsidized content.

And as Meta struggles with its ad-supported business model, digital TV is only growing quicker. Our learnings from consumers canceling their memberships unraveled how tough it is to know which streaming platform your consumer can be found on to deliver them effective messaging. Advertisers must be aware that consumers buying from one streaming service is dead and gone. The most effective way of buying media for advertisers in 2022 is buying or bidding across all TV streaming platforms with programmatic advertising.