Viewers’ habits, like their subscription services, are ever-changing, mirroring the dynamic nature of the advertising industry.

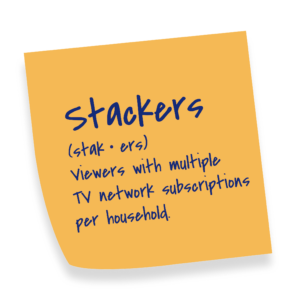

While viewers hop from one platform to another, the number of subscriptions per household keeps rising. In 2019, viewers averaged 2.8 streaming services. By 2023, that surged to 5.5 subscriptions. And this is what we call stackers. With stackers growing rapidly, Keynes Digital is seeing our YoY conversion rate averages skyrocket across the board–In 2022, we saw a 50% increase compared to 2021 and an even greater jump in 2023 to 93%.

While viewers hop from one platform to another, the number of subscriptions per household keeps rising. In 2019, viewers averaged 2.8 streaming services. By 2023, that surged to 5.5 subscriptions. And this is what we call stackers. With stackers growing rapidly, Keynes Digital is seeing our YoY conversion rate averages skyrocket across the board–In 2022, we saw a 50% increase compared to 2021 and an even greater jump in 2023 to 93%.

Between 2021 and 2022, stackers caused binge-watching chaos for streaming TV networks. People found loopholes, opting out of paying or choosing small fees for ad-supported content.

In 2023, TV networks got crafty themselves, entering new sectors and adding engaging content. The year’s big focus was on sports and AI, with every streaming service highlighting growth in sports-specific content and plans to expand into documentaries and live sports throughout this year.

AI remains a focal point, promising better user experiences and personalized recommendations. As AI continues to develop, the potential for innovations is massive, ushering in a new era of adtech in the near future, another trend we should all prepare for.

Takeaways in Streaming TV 2023

- 99% of US households have at least one digital TV subscription (Forbes)

- Ad-Supported Video-On-Demand (AVod) increased by 40% (Cross Screen Media)

- Change in ratings for 2023 vs. 2021, according to Anthony Crupi:

- NFL regular season – ↑ 4%

- Overall linear TV – ↓ 18%

- Free Ad-Supported TV (FAST) is up 288% in year-over-year change for total TV time (Cross Screen Media)

- Amazon Prime is being more strategic with its audience focus, particularly in the 18–34 year-old demographic. (Amazon Earnings)

- Apple’s paid subscriptions grew double digits year over year, surpassing 1 billion subscriptions. (Apple Earnings)

- Comcast (Peacock) gained 10 million paid subscribers, with a 3 million net increase driven by sports (NFL and the Big 10) and movies (Five Nights at Freddy’s and a variety of originals). (Peacock Earnings)

- Every streaming service is incorporating sports and documentaries into their platforms

- 2024 trend to be aware of: CPMs are expected to peak this year as networks gain more control; however, as the market actualizes these will drop back down. (Reuters)

Why should you care?

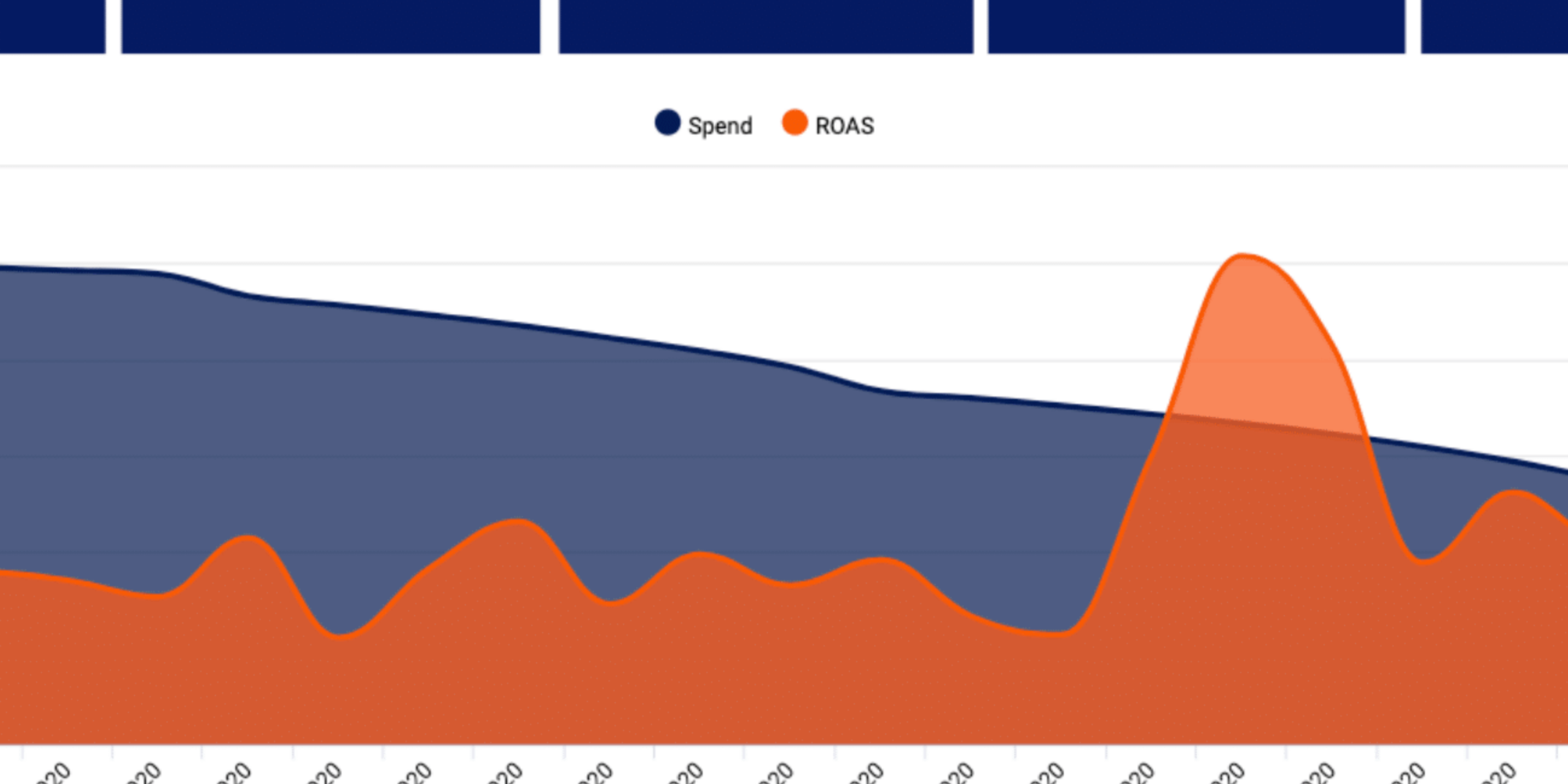

In response to shifting consumer behavior, networks focused on producing more content to retain subscribers. As viewers embrace flexible subscription models, jumping from one streaming platform to the next, advertisers can find immense opportunities in connected TV. With programmatic connected TV advertising, why wouldn’t advertisers take advantage of reaching users who cancel subscriptions and hop to another platform? Advertisers can reach users across multiple services like Apple TV+, Peacock, and Prime Video, maximizing audience engagement and ad effectiveness.

As networks intensify their competition and churn out must-watch shows and movies, streaming TV stackers rise, offering you a broader audience reach through programmatic advertising. This approach enables you to adapt to evolving consumer habits and capitalize on the fluidity of subscription services, ultimately driving better ROI and engagement for your campaigns.

The big players are making big moves to adapt to stackers’ consumption behaviors. You shouldn’t miss this opportunity to learn to be proactive and adapt to your audiences’ habits. Take advantage of these opportunities to dive into new channels and utilize AI before getting left behind as the industry evolves.

Are you keeping up with the times? Keep up with Keynes. Do you want to better understand how this affects the potential of your business? Chat with one of our partners.